GSF India founded by Rajesh Sawhney has come out with

a report on ‘The State of Early Stage Investing in India March 2013’ which maps

the mood of investment ecosystem in the country for 2013. Based on a number of

reports and data, post GSF2012 held on Nov 26-27 the insights have been

prepared after interacting with VCs and Angels on their plans ahead for the

year.The report is co-authored by Rajesh Sawhney and Esha Tiwary, Chief Marketing Officer, Cloudnine.

Methodology - The insights presented here are based on

self-reported information by the opinion leaders and influencers in the early

stage Indian entrepreneurship ecosystem. The leading 40 VCs and Angels were

surveyed through a structured online questionnaire.

Investors interested in Non-ecommerce ventures :- The

investor sentiment seems neutral to slightly positive at best for 2013.

Investors are wary of ecommerce investments are keen on non-ecommerce sectors

in 2013. The only exceptions to this general outlook are Seed Funds, who are

extremely bullish and are contributing a significant chunk of early stage

investments in India.

Investments by VCs and Angels in 2012:-

In 2012, most VCs made less than ten investments and most

Angels restricted to less than five investments. In the deals that did happen,

a growing amount of participation by VCs in Seed rounds was observed. In fact,

there was more Seed level participation than Series A participation by VCs (in

number of deals).

VCs and seasoned Angels investing across stages and are

collaborating in deals:-

The report further states that 2012 witnessed both Angels

and VCs investing across “stages”. In fact, a growing collaboration between

Angels and VCs further corroborates this paradigm shift. 61% of Angels surveyed

said there was greater collaboration in 2012 than in 2011. They sense that this

collaboration will keep increasing as VCs continue to move down the “value

chain” of investing.

Amongst the VC deals of 2012, 42 percent are of Seed funding

followed by Series A (36%), Series B (12%) and higher (11%). In respect to

angel deals, seed funding was the top most category with a whopping 79% share

followed by Series A (15%) Series B (6%).

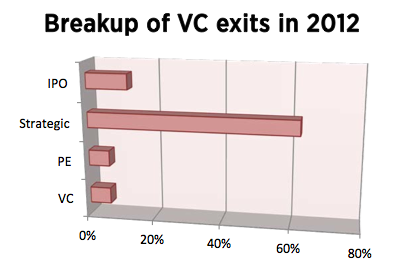

Lack of exits :- The report noted that lack of exits/ insufficient exit

options is the key concern for VCs and seasoned angels. Angels saw very few

exits in 2012 while VCs had strategic divestments forming the bulk of their

exits in 2012 a little over 60 percent. They expect this lull to continue in

2013, with strategic exits remaining the vast majority despite their

sub-optimal returns.

The report concludes by mentioning building of

mobile internet with 3G and 4G network rollouts. New Angel investors are

providing fresh capital to early stage startups (while seasoned ones are

becoming weary, as our survey reveals), and a few accelerators and incubators

have announced aggressive plans for 2013.